Explainer: How Singapore's unique monetary policy works

Explainer: How Singapore's Unique Monetary Policy Works

If you've been following global finance trends lately, you know the script: Central banks battle soaring inflation by hiking interest rates. From the US Federal Reserve to the European Central Bank, the weapon of choice is the overnight lending rate. It's a familiar playbook used globally—except for Singapore.

As the world grapples with persistent price pressures, the Monetary Authority of Singapore (MAS) continues to operate on a different frequency. They don't target interest rates; they target the exchange rate. This seemingly subtle difference is the key to understanding Singapore's remarkable economic stability and its highly effective inflation control mechanism. But why does this small, highly open economy defy conventional monetary wisdom?

I recall sitting in a global economics seminar years ago, watching my professor dismiss interest rate policy in Singapore with a wave of his hand. "They are too small, too open. Any attempt to manage rates would be instantly overwhelmed by global capital flows," he said. This profound vulnerability is precisely what forced the MAS to innovate, turning a structural weakness into a strategic advantage.

This deep-dive explains how Singapore uses its currency—the Singapore Dollar (SGD)—as its primary tool for achieving price stability and managing economic growth. Understanding this model is crucial for anyone investing or operating within this crucial Asian hub.

The Core Difference: Exchange Rates, Not Interest Rates

The fundamental reason Singapore shuns interest rate manipulation lies in its definition as a "small and highly open economy." Singapore imports virtually all its food, energy, and raw materials. Furthermore, its financial borders are incredibly permeable, meaning capital moves in and out freely.

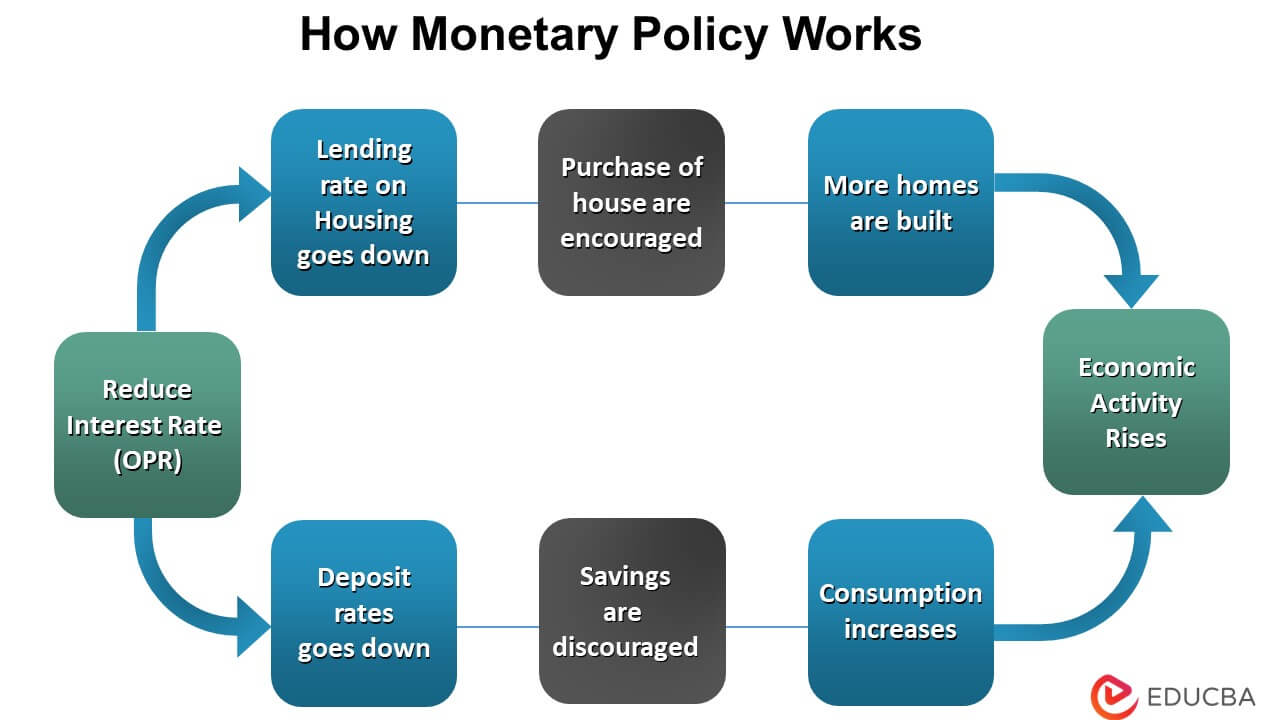

In classical economics, if a central bank tries to push domestic interest rates higher to cool down borrowing (as the Fed does), global investors would immediately flood the country with capital seeking higher returns. This massive inflow of foreign funds would put upward pressure on the local currency, completely neutralizing the central bank's initial interest rate hike attempt within minutes.

Because domestic interest rates are overwhelmingly determined by global rates (like the US Fed Funds Rate) due to this capital mobility, the MAS recognized early on that controlling local borrowing costs was a futile exercise. They needed a more direct way to influence the cost of imports—the primary driver of inflation in Singapore.

The solution was simple yet brilliant: Since inflation is largely imported, control the currency's strength to influence the price of those imports. A stronger SGD makes foreign goods, commodities, and energy cheaper, directly acting as an anti-inflationary tool. This focus on the exchange rate is known as Singapore's unique exchange rate-centered monetary policy.

Key differences compared to typical inflation targeting models:

- Primary Policy Tool: Exchange Rate (S$NEER), not the Overnight Interest Rate.

- Focus of Control: Imported Inflation (via currency strength) rather than Domestic Demand (via borrowing costs).

- Intervention Method: Buying and selling SGD on the foreign exchange market to keep the currency within a pre-defined band.

- Interest Rates: Largely determined by market forces and international capital movements, often following US interest rates.

MAS conducts policy reviews typically twice a year (April and October), though it can convene emergency meetings if global economic shifts require immediate action. The outcome of these reviews isn't a new interest rate target; it's an adjustment to the structure of the currency band.

Understanding the S$NEER Policy Band

The Singapore Dollar Nominal Effective Exchange Rate (S$NEER) is the backbone of this policy. It is not based on the SGD's value against just one currency (like the US Dollar) but against a weighted basket of currencies belonging to Singapore's major trading partners and competitors.

This approach ensures that MAS manages the currency's value relative to its overall trade flows, making the policy economically relevant. The MAS does not disclose the exact composition or weightings of this basket, adding an element of operational secrecy that prevents speculators from attacking the currency easily.

Instead of setting a fixed value, MAS manages the S$NEER within a target band, often described as a "managed float." The MAS uses three distinct tools to adjust this band, each representing a different degree of monetary tightening or easing:

1. The Slope (The Pace of Appreciation)

The slope dictates how quickly the SGD is allowed to strengthen over time. A steeper slope signals a policy tightening—meaning MAS wants the currency to appreciate faster to combat inflation. This is the most frequently adjusted tool and reflects the medium-term stance of the MAS.

2. The Centre (The Midpoint of the Band)

The centre is the specific midpoint around which the S$NEER is allowed to fluctuate. When the MAS "re-centres" the band, it is typically a strong signal of a significant policy shift. Shifting the centre point upwards is a powerful tightening move, instantly boosting the value of the currency basket.

3. The Width (The Tolerance for Volatility)

The width determines the permissible range of fluctuation around the centre line. A wider band allows for more currency volatility due to short-term market noise, while a narrower band implies more active intervention by the MAS to keep the exchange rate stable. The width is rarely adjusted unless global market uncertainty dramatically increases.

When the MAS tightens policy, they are effectively doing one or more of the following: steepening the slope, raising the centre, or (less frequently) narrowing the width. These adjustments are publicly announced, providing clarity on the policy direction while maintaining secrecy on the exact operational parameters.

The effectiveness of this system is evident during inflationary periods. For example, during the high global inflation environment post-COVID (2021-2023), MAS engaged in an unprecedented series of tightening moves, often relying on both slope steepening and re-centering the band to ensure the SGD was strong enough to absorb global price shocks.

Why This Policy Works for Singapore (And Its Limitations)

The S$NEER framework is uniquely tailored to Singapore's structural realities. Its key strength is its immediate and direct impact on the prices of imported goods, making it highly effective at tackling imported inflation—Singapore's primary economic vulnerability.

By forcing the currency higher, MAS directly reduces the cost of fuel, raw materials, and components for local businesses and consumers. This mechanism works faster and more effectively than standard interest rate policy, which relies on a delayed transmission mechanism through domestic borrowing and investment decisions.

Furthermore, MAS policy contributes significantly to the long-term goal of fostering financial and economic stability. Because the policy is forward-looking and focuses on maintaining the country's strong purchasing power, it reinforces Singapore's status as a stable hub for multinational corporations.

The Policy Tightening Cycle

When MAS signals a "tightening" of monetary policy, global financial markets immediately understand this means a stronger SGD is imminent. MAS achieves this strength by intervening in the currency market, selling Singapore Dollars in exchange for foreign currency when the SGD risks dropping below the lower threshold of the band, or conversely, selling foreign currency to buy SGD when it nears the upper limit.

- When inflation is low: MAS may adopt a zero slope (allowing the SGD to hold steady) or a shallow slope (slow, modest appreciation).

- When inflation is high: MAS tightens by steepening the slope and possibly re-centering the band upwards, ensuring aggressive currency appreciation.

Limitations and Future Challenges

While highly effective, the policy isn't without limitations. A persistently strong SGD, while curbing imported inflation, can hurt the competitiveness of Singapore's exports, making Singaporean goods and services more expensive globally. MAS must therefore constantly balance price stability with export competitiveness—a delicate act of calibration.

Another emerging challenge is the rising importance of domestic costs, particularly housing and labor. Exchange rate policy is less effective at taming inflation driven by purely domestic factors. For these elements, the MAS often relies on complementary fiscal policies and structural measures coordinated by the government to manage cost of living and wage growth.

In a world characterized by geopolitical friction and supply chain volatility, the S$NEER framework remains a globally watched model. It demonstrates that for small, highly globalized economies, monetary policy must adapt fundamentally, prioritizing the exchange rate to secure the long-term purchasing power and stability required for a leading financial center.

Explainer: How Singapore's unique monetary policy works

Explainer: How Singapore's unique monetary policy works Wallpapers

Collection of explainer: how singapore's unique monetary policy works wallpapers for your desktop and mobile devices.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Photo in 4K

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works Capture Digital Art

Discover an amazing explainer: how singapore's unique monetary policy works background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Landscape Photography

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Beautiful Explainer: How Singapore's Unique Monetary Policy Works Picture Concept

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

Exquisite Explainer: How Singapore's Unique Monetary Policy Works Wallpaper for Mobile

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Lush Explainer: How Singapore's Unique Monetary Policy Works Photo in 4K

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Stunning Explainer: How Singapore's Unique Monetary Policy Works Abstract for Desktop

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

Serene Explainer: How Singapore's Unique Monetary Policy Works Capture for Your Screen

Discover an amazing explainer: how singapore's unique monetary policy works background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Explainer: How Singapore's Unique Monetary Policy Works Background Photography

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

Exquisite Explainer: How Singapore's Unique Monetary Policy Works Artwork Concept

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Vibrant Explainer: How Singapore's Unique Monetary Policy Works Background Nature

Experience the crisp clarity of this stunning explainer: how singapore's unique monetary policy works image, available in high resolution for all your screens.

Breathtaking Explainer: How Singapore's Unique Monetary Policy Works Picture Nature

Explore this high-quality explainer: how singapore's unique monetary policy works image, perfect for enhancing your desktop or mobile wallpaper.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works Wallpaper Art

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Artistic Explainer: How Singapore's Unique Monetary Policy Works Photo Illustration

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Serene Explainer: How Singapore's Unique Monetary Policy Works Background in HD

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Mesmerizing Explainer: How Singapore's Unique Monetary Policy Works Scene Nature

Transform your screen with this vivid explainer: how singapore's unique monetary policy works artwork, a true masterpiece of digital design.

Gorgeous Explainer: How Singapore's Unique Monetary Policy Works Design Photography

A captivating explainer: how singapore's unique monetary policy works scene that brings tranquility and beauty to any device.

Crisp Explainer: How Singapore's Unique Monetary Policy Works Abstract Art

Find inspiration with this unique explainer: how singapore's unique monetary policy works illustration, crafted to provide a fresh look for your background.

High-Quality Explainer: How Singapore's Unique Monetary Policy Works View Nature

Experience the crisp clarity of this stunning explainer: how singapore's unique monetary policy works image, available in high resolution for all your screens.

Artistic Explainer: How Singapore's Unique Monetary Policy Works Artwork Illustration

Immerse yourself in the stunning details of this beautiful explainer: how singapore's unique monetary policy works wallpaper, designed for a captivating visual experience.

Download these explainer: how singapore's unique monetary policy works wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Explainer: How Singapore's unique monetary policy works"

Post a Comment