Singapore bank wealth fees surge 44% to defy NIM squeeze

Singapore Bank Wealth Fees Surge 44% to Defy NIM Squeeze

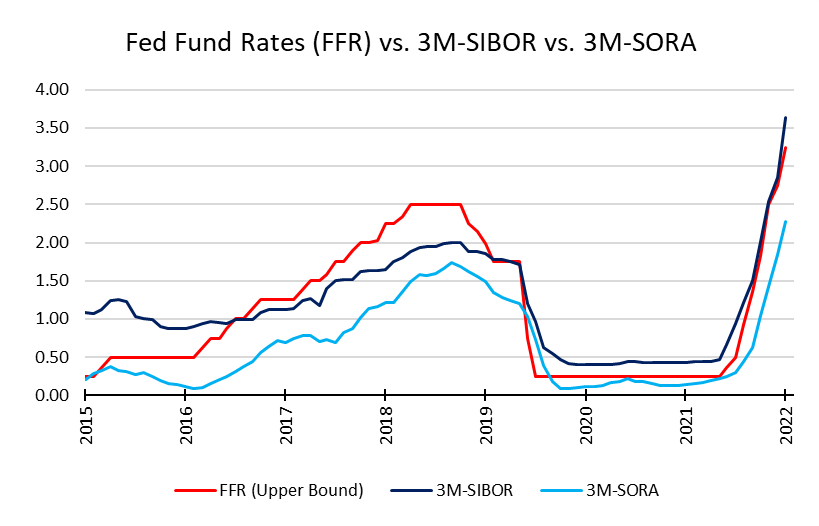

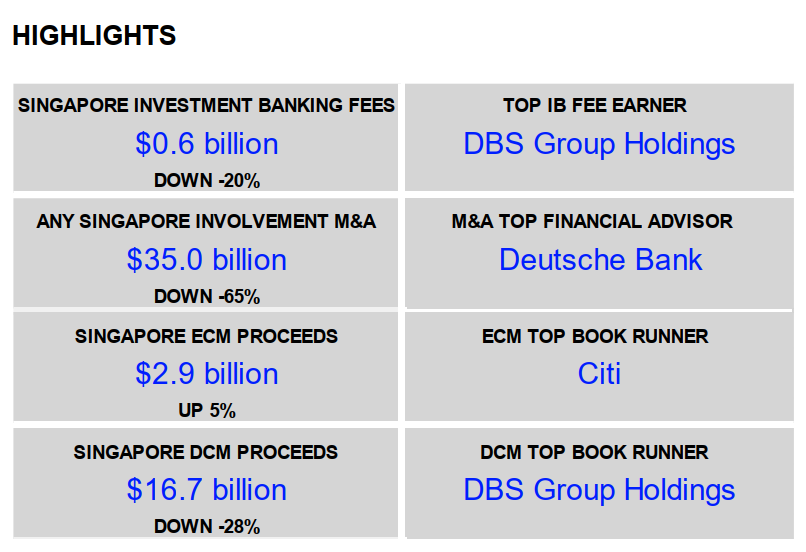

The global banking sector is currently fixated on one metric: the Net Interest Margin (NIM). As central banks pivot towards anticipated rate cuts, the pressure on traditional lending profitability—the NIM squeeze—is a palpable threat. Yet, Singapore's major banking players are painting an entirely different picture of earnings resilience, driven by a record-breaking surge in wealth management fees.

In a powerful demonstration of strategic pivoting, recent consolidated results show that non-interest income generated from wealth management and private banking divisions across Singapore's banking giants has exploded, surging by an average of 44% year-over-year. This unprecedented growth is effectively insulating these institutions from the impending margin pressure, redefining their future earnings profile.

I recently spoke to a long-time private banking client, Mr. Chen, who manages a family office portfolio. He noted, "The service level has definitely gone up, but so have the charges. They are moving us away from basic trade execution to much more complex, high-fee structured products. I see the value, but the cost transparency is often buried in the sheer complexity of the bespoke portfolios."

Mr. Chen's experience reflects the broader institutional strategy: moving clients up the fee value chain. This shift is not accidental; it is a calculated response to a changing monetary landscape and Singapore's solidified position as Asia's premier wealth hub.

The New Engine: How Fee Income Overpowers NIM Pressure

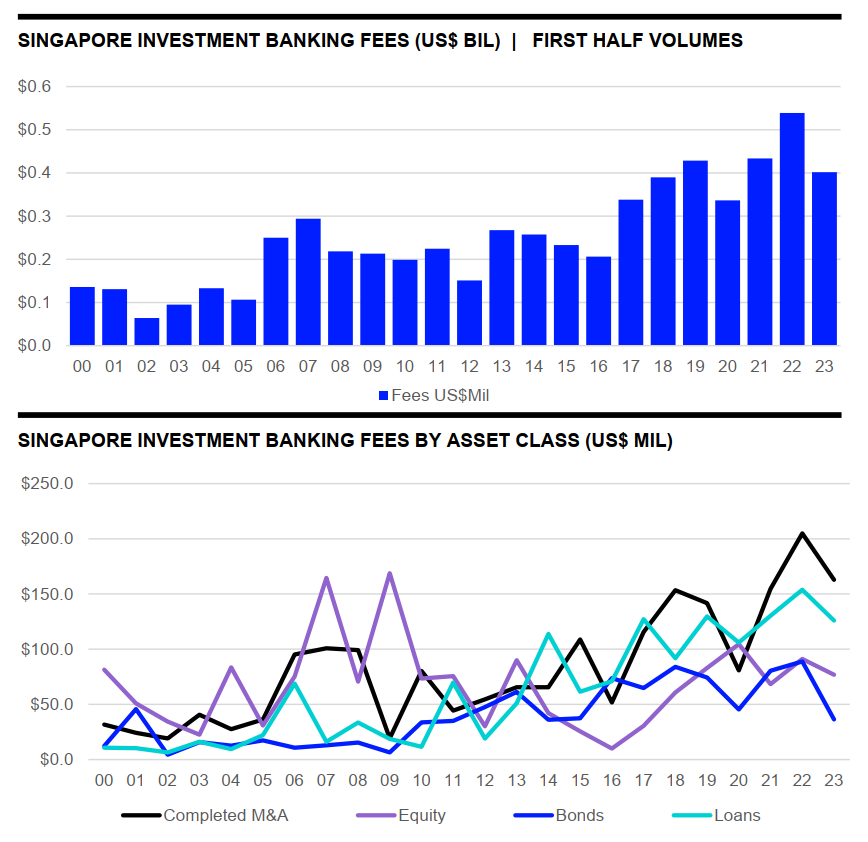

For decades, the profitability of Southeast Asian banks was largely dependent on loan books and the spread between deposit and lending rates. NIM was king. While high-interest rates over the past two years delivered windfall profits, analysts have been cautious about sustainability. That caution now seems overstated, thanks to the dynamic performance of the wealth segment.

The 44% jump in wealth management fees is a clear indicator that diversification efforts are paying off handsomely. This isn't just organic growth; it reflects aggressive cross-selling, increased client activity in capital markets, and—crucially—a pivot toward higher-margin, sticky services.

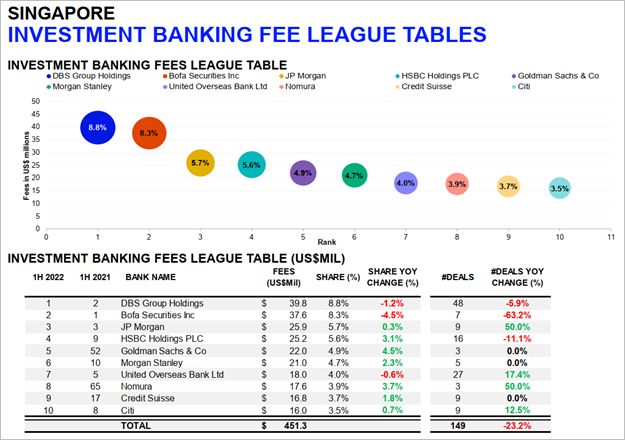

Financial analysts highlight that this surge is significantly boosting the fee-to-NIM ratio, demonstrating a structural improvement in profitability. Banks like DBS, OCBC, and UOB have leveraged their extensive regional network and digital capabilities to capture a larger share of the region's growing pool of Asset Under Management (AUM).

The components driving this fee growth are multifaceted:

- Discretionary Portfolio Management (DPM): Banks are increasingly moving clients into DPM mandates, which command recurring, higher management fees regardless of transaction volume.

- Structured Products: The demand for complex investment vehicles, often linked to market volatility or specific hedging needs, generates large upfront advisory and execution fees.

- Unit Trust and Fund Distribution: Increased retail investor confidence and robust marketing campaigns have pushed volumes in mutual funds, providing stable trailer fees.

- Brokerage and Custody Fees: While transaction volumes have softened slightly, the massive influx of HNW (High-Net-Worth) and UHNW (Ultra-High-Net-Worth) individuals ensures robust custody and administrative fees.

This powerful acceleration in wealth fees provides a crucial counterbalance. A potential 5-10 basis point drop in NIM across the sector, anticipated if the US Federal Reserve implements multiple rate cuts, will now be absorbed, or even negated, by the robust non-interest income stream.

Riding the Wave: The Rise of Asia's Ultra-High-Net-Worth Individuals (UHNW)

The impressive fee growth is underpinned by Singapore's geopolitical advantage. As wealth flows diversify out of traditional hubs, the city-state has cemented its reputation for regulatory stability, political neutrality, and world-class infrastructure. This has led to a torrent of capital flight directed towards Singaporean private banks.

The sheer velocity of UHNW migration is driving the current AUM expansion. Many family offices previously based in Hong Kong or European centers are establishing dual or primary presences in Singapore. These clients bring vast, complex assets that require sophisticated, fee-generating services.

The growth isn't just about quantity; it's about quality of assets. The average size of new client portfolios is increasing, giving banks significant pricing power. When dealing with multi-billion-dollar family offices, the fee percentages, though seemingly small, translate into massive revenue streams.

Furthermore, Singaporean banks have aggressively hired relationship managers (RMs) and expanded their geographic reach, particularly into markets like Indonesia, Thailand, and China. This strategic talent acquisition allows them to capture cross-border flows that might otherwise go to international competitors.

A recent report by a major consultancy highlighted that Asian UHNW clients prioritize "holistic wealth planning" over simple investment advice. This includes trust administration, succession planning, philanthropy advisory, and specialized lending—all high-margin activities that fall squarely into the fee-income category, further insulating the banks from traditional lending cycle vulnerabilities.

This symbiotic relationship—Singapore offering stability, and the banks offering customized, high-touch services—is creating a virtuous cycle where AUM growth fuels fee growth, which in turn attracts more capital.

Strategies for Sustained Growth: Beyond Basic Brokerage

The banking sector knows that relying purely on market uplift is risky. To ensure the 44% surge is sustainable, banks are focusing on structural changes designed to lock in future revenue streams, even in periods of market deceleration.

The future of wealth fee generation lies in integration and personalization. Singapore's leading banks are moving away from merely being transaction platforms towards becoming holistic financial advisors.

Deepening Client Penetration through Digitalization

While UHNW services remain relationship-driven, technology is playing a key role in serving the affluent and mass-affluent segments. Robust digital wealth platforms allow banks to scale advisory services, offer fractional investment opportunities, and automate compliance, reducing operational costs while expanding the addressable market for fee products. This digitalization broadens the base upon which wealth fees are charged.

The Focus on Advisory and Capital Markets

In a volatile economic environment, clients pay premiums for expertise. Banks are prioritizing high-level advisory services, particularly around IPOs, private equity placements, and complex debt restructuring. These capital markets activities often sit within the wealth division, generating massive one-off transaction fees.

The emphasis on environmental, social, and governance (ESG) investments is also proving to be a high-fee catalyst. Specialized ESG funds and structured sustainable products attract higher management charges due to the complexity of due diligence and reporting.

Operational Efficiency and Cost Management

The increased revenue is amplified by simultaneous improvements in cost-to-income ratios within the wealth divisions. By streamlining back-office functions and leveraging AI for risk management and compliance, the operational efficiency gains mean that a greater portion of the 44% revenue surge flows directly to the bottom line.

The Long-Term Implications for Shareholders

The surge in Singapore bank wealth fees represents more than just a quarterly success story; it signals a fundamental shift in the regional banking model. Banks are successfully migrating their dependency away from volatile interest rate cycles towards predictable, sticky, and high-margin recurring fee income.

For shareholders, this diversification offers enhanced dividend security and stability in earnings, making these stocks increasingly attractive in a global environment marked by macro-economic uncertainty. The ability to generate such significant wealth fees validates Singapore's status as a formidable global financial center, capable of not only attracting capital but also monetizing sophisticated financial services at an unmatched scale.

The NIM squeeze may be coming, but thanks to the wealth fee surge, Singapore's banks are strategically positioned to navigate the turbulence with enviable profitability.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Singapore bank wealth fees surge 44% to defy NIM squeeze Wallpapers

Collection of singapore bank wealth fees surge 44% to defy nim squeeze wallpapers for your desktop and mobile devices.

Captivating Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Wallpaper for Your Screen

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Gorgeous Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze View Art

Immerse yourself in the stunning details of this beautiful singapore bank wealth fees surge 44% to defy nim squeeze wallpaper, designed for a captivating visual experience.

Gorgeous Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Picture Photography

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Exquisite Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Image Illustration

Find inspiration with this unique singapore bank wealth fees surge 44% to defy nim squeeze illustration, crafted to provide a fresh look for your background.

Stunning Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background for Your Screen

Find inspiration with this unique singapore bank wealth fees surge 44% to defy nim squeeze illustration, crafted to provide a fresh look for your background.

Breathtaking Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Abstract Digital Art

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Artistic Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Photo Illustration

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Artistic Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork Photography

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

Crisp Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork Photography

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background Concept

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Lush Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Design for Mobile

A captivating singapore bank wealth fees surge 44% to defy nim squeeze scene that brings tranquility and beauty to any device.

High-Quality Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Artwork for Desktop

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Moment in HD

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Detailed Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Background Illustration

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Capture Nature

Experience the crisp clarity of this stunning singapore bank wealth fees surge 44% to defy nim squeeze image, available in high resolution for all your screens.

Vibrant Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Scene Illustration

Explore this high-quality singapore bank wealth fees surge 44% to defy nim squeeze image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze View for Mobile

Discover an amazing singapore bank wealth fees surge 44% to defy nim squeeze background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Image for Mobile

Explore this high-quality singapore bank wealth fees surge 44% to defy nim squeeze image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Wallpaper in 4K

This gorgeous singapore bank wealth fees surge 44% to defy nim squeeze photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid Singapore Bank Wealth Fees Surge 44% To Defy Nim Squeeze Design Digital Art

Transform your screen with this vivid singapore bank wealth fees surge 44% to defy nim squeeze artwork, a true masterpiece of digital design.

Download these singapore bank wealth fees surge 44% to defy nim squeeze wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Singapore bank wealth fees surge 44% to defy NIM squeeze"

Post a Comment