Oil slides over 5% as Trump signals Iran talks, easing supply shock fears

Oil Slides Over 5% as Trump Signals Iran Talks, Easing Supply Shock Fears

The global oil market experienced a sharp and dramatic reversal today, with prices plunging by more than 5%. This massive sell-off was directly triggered by unexpected diplomatic signals from Washington, indicating a potential opening for talks between the U.S. and Iran. The sudden easing of long-held geopolitical risk fears instantly shattered market bullishness, causing benchmark crude futures to wipe out days of gains.

For weeks, drivers and industry leaders worldwide have braced for escalating fuel costs. I personally remember filling my tank just two days ago, muttering about the relentless upward creep of gasoline prices, fearing a return to crippling $4-a-gallon averages spurred by tensions in the Middle East. That anxiety defined the market landscape—until this morning.

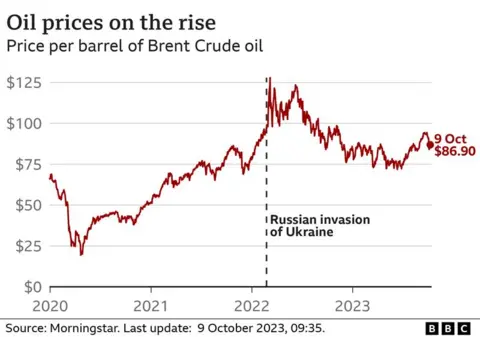

West Texas Intermediate (WTI) crude, the U.S. benchmark, plummeted well below the critical $60-a-barrel threshold, while international benchmark Brent crude futures mirrored the decline, showing the deepest intraday drop seen in months. This swift deceleration confirms a core market principle: perception of supply matters more than current supply volume, especially when that perception is driven by high-stakes diplomacy.

The Diplomatic Pivot: How Talk Signals Decimated Geopolitical Premiums

The primary catalyst for the market's violent downward adjustment was a series of statements signaling President Trump's willingness to meet with Iranian officials "without preconditions" to discuss the ongoing nuclear standoff and regional stability. This shift in tone marks a significant departure from the maximal pressure campaign that has defined U.S.-Iran relations since the withdrawal from the Joint Comprehensive Plan of Action (JCPOA).

The market interpreted the mere possibility of dialogue as drastically reducing the probability of military conflict or further escalation in the Middle East. Since early 2019, crude prices have carried a substantial "geopolitical premium"—an extra cushion reflecting the risk that Iranian retaliation or accidental conflict could disrupt crucial shipping lanes, particularly the Strait of Hormuz.

When the possibility of a diplomatic off-ramp emerged, this premium evaporated almost instantaneously. Traders who had banked on continued high tensions driving prices higher rushed to liquidate their long positions, accelerating the slide.

Key market triggers following the announcement:

- Risk-Off Sentiment: Financial players rapidly switched from holding oil futures to safer assets, signaling relief over conflict avoidance.

- Sanctions Easing Hope: Although official sanctions remain in place, the signaling of talks opens the door to future agreements that could see Iranian oil return to the global market, increasing supply dramatically.

- Currency Fluctuations: The U.S. Dollar reacted to the perceived stability, impacting commodity pricing globally, adding downward pressure on crude futures.

While the talks remain highly speculative and success is far from guaranteed, the market is currently pricing in the most optimistic outcome: a de-escalation that ensures regional production remains uninterrupted. The focus has decisively shifted from imminent conflict to potential negotiated resolution.

Unpacking the Pre-Existing Supply Shock Fears

To fully understand why a 5% slide was possible, we must first recognize the extreme level of supply anxiety the market was managing prior to today's news. The threat environment was multilayered, meaning prices were artificially inflated by numerous non-production factors.

The severe U.S. sanctions targeting Iranian crude exports had already removed approximately 2 million barrels per day (bpd) from the global supply chain. This deliberate tightening created a delicate balance, vulnerable to any further shock. Analysts were already concerned that any minor incident could trigger a massive spike similar to the crises of the 1970s.

The concentration of global crude passage through the Strait of Hormuz—a narrow choke point through which roughly one-fifth of the world's oil supply passes—amplified these fears. Previous incidents involving seized tankers and drone activity had kept investors on edge, believing that Iran might move to close or severely restrict the strait if diplomatic avenues failed.

The market had priced in worst-case scenarios:

First, the fear that a miscalculation could lead to an armed conflict that halts crude shipments from major producers like Saudi Arabia and the UAE.

Second, sustained production cuts by the OPEC+ coalition (Organization of the Petroleum Exporting Countries and its allies, including Russia) were designed to stabilize prices, but their effectiveness was constantly undermined by the geopolitical instability, forcing prices higher than OPEC intended.

Today's news acts like a release valve on a pressurized system. The immediate consensus is that the highest risks of disruption have been temporarily pushed back, giving the market room to breathe and, crucially, to re-evaluate the true underlying price of crude stripped of war risk.

Beyond Geopolitics: Inventory Data and Global Demand Worries

While geopolitical shifts grabbed the headlines, the substantial decline in oil prices was also assisted by underlying fundamental market weaknesses, particularly concerning global demand growth and inventory reports. These factors provide a floor for bearish sentiment, reinforcing the political slide.

Recent data published by the Energy Information Administration (EIA) in the U.S. showed a surprisingly large build in crude inventories. Instead of showing the typical summer draws, U.S. commercial crude stockpiles increased by several million barrels, defying expectations set by the American Petroleum Institute (API).

High U.S. production, particularly from the Permian Basin, continues to flood the market, offsetting some of the supply reductions caused by international sanctions. This domestic supply strength acts as a dampener, capping upward price movements.

Furthermore, persistent anxiety regarding the global economic outlook cannot be overstated. The protracted U.S.-China trade dispute continues to cast a long shadow over global manufacturing and transportation forecasts. Oil demand is highly correlated with global GDP growth, and projections are consistently being revised downwards.

- Manufacturing Slowdown: Factory activity across major economies like Germany and China has softened, leading to reduced energy consumption in the industrial sector.

- Shipping Demand Drop: International freight and container movements have decelerated, reducing demand for bunker fuel.

- Recession Fears: Rising fears of a global recession suggest that future oil consumption may be significantly lower than previously modeled, placing a structural weakness beneath price targets.

The convergence of overwhelming domestic supply, weak international demand signals, and the sudden relaxation of geopolitical risk created a perfect storm for today's steep decline. It moves the focus away from tight physical supply and toward the reality of sufficient global reserves.

Outlook: Volatility Remains as Talks Loom

While the market celebrates the reprieve from the threat of war, significant uncertainty remains, ensuring high volatility in the coming days and weeks. The 5% drop is a reaction to a signal, not a fully signed agreement. The path to substantive, successful talks with Iran is fraught with obstacles.

For the decline to be sustained, actual progress must be made on lifting sanctions and normalizing relations. If the talks stall or break down—a highly possible scenario given the entrenched positions of both sides—the geopolitical premium could quickly snap back, sending prices soaring again.

Market participants are now keenly watching several key indicators:

- Any official confirmation or scheduling of a meeting between high-level U.S. and Iranian officials.

- The reaction and compliance levels of OPEC+ producers, particularly Saudi Arabia, which may face pressure to cut production further to counter the sharp price decline.

- Upcoming EIA inventory reports, which will confirm whether the recent build-up was an anomaly or a sustained trend.

Today's dramatic market action serves as a crucial reminder that oil prices are driven as much by diplomatic tweets and political rhetoric as they are by barrels pumped. For the moment, relief has swept through the crude futures market, pushing prices firmly into bearish territory, but the fundamental instability of the Middle East ensures that traders will remain highly sensitive to any shift in the geopolitical wind.

Oil slides over 5% as Trump signals Iran talks, easing supply shock fears

Oil slides over 5% as Trump signals Iran talks, easing supply shock fears Wallpapers

Collection of oil slides over 5% as trump signals iran talks, easing supply shock fears wallpapers for your desktop and mobile devices.

Lush Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Wallpaper for Desktop

Immerse yourself in the stunning details of this beautiful oil slides over 5% as trump signals iran talks, easing supply shock fears wallpaper, designed for a captivating visual experience.

High-Quality Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears View Illustration

Discover an amazing oil slides over 5% as trump signals iran talks, easing supply shock fears background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Wallpaper for Mobile

Experience the crisp clarity of this stunning oil slides over 5% as trump signals iran talks, easing supply shock fears image, available in high resolution for all your screens.

Spectacular Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Picture Art

A captivating oil slides over 5% as trump signals iran talks, easing supply shock fears scene that brings tranquility and beauty to any device.

Gorgeous Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Photo Digital Art

A captivating oil slides over 5% as trump signals iran talks, easing supply shock fears scene that brings tranquility and beauty to any device.

Serene Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Landscape Digital Art

Explore this high-quality oil slides over 5% as trump signals iran talks, easing supply shock fears image, perfect for enhancing your desktop or mobile wallpaper.

Amazing Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Design in 4K

Experience the crisp clarity of this stunning oil slides over 5% as trump signals iran talks, easing supply shock fears image, available in high resolution for all your screens.

Stunning Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Moment for Desktop

A captivating oil slides over 5% as trump signals iran talks, easing supply shock fears scene that brings tranquility and beauty to any device.

Amazing Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Photo for Your Screen

Discover an amazing oil slides over 5% as trump signals iran talks, easing supply shock fears background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Crisp Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Wallpaper Collection

This gorgeous oil slides over 5% as trump signals iran talks, easing supply shock fears photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Stunning Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Abstract Collection

This gorgeous oil slides over 5% as trump signals iran talks, easing supply shock fears photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Abstract in HD

Discover an amazing oil slides over 5% as trump signals iran talks, easing supply shock fears background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Artwork Art

Experience the crisp clarity of this stunning oil slides over 5% as trump signals iran talks, easing supply shock fears image, available in high resolution for all your screens.

Amazing Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Moment Concept

Transform your screen with this vivid oil slides over 5% as trump signals iran talks, easing supply shock fears artwork, a true masterpiece of digital design.

Serene Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Abstract Digital Art

Transform your screen with this vivid oil slides over 5% as trump signals iran talks, easing supply shock fears artwork, a true masterpiece of digital design.

Captivating Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Capture Collection

Find inspiration with this unique oil slides over 5% as trump signals iran talks, easing supply shock fears illustration, crafted to provide a fresh look for your background.

Stunning Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears View Photography

Immerse yourself in the stunning details of this beautiful oil slides over 5% as trump signals iran talks, easing supply shock fears wallpaper, designed for a captivating visual experience.

Dynamic Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Landscape Concept

Immerse yourself in the stunning details of this beautiful oil slides over 5% as trump signals iran talks, easing supply shock fears wallpaper, designed for a captivating visual experience.

Crisp Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Picture Concept

Immerse yourself in the stunning details of this beautiful oil slides over 5% as trump signals iran talks, easing supply shock fears wallpaper, designed for a captivating visual experience.

Beautiful Oil Slides Over 5% As Trump Signals Iran Talks, Easing Supply Shock Fears Wallpaper Collection

Experience the crisp clarity of this stunning oil slides over 5% as trump signals iran talks, easing supply shock fears image, available in high resolution for all your screens.

Download these oil slides over 5% as trump signals iran talks, easing supply shock fears wallpapers for free and use them on your desktop or mobile devices.

0 Response to "Oil slides over 5% as Trump signals Iran talks, easing supply shock fears"

Post a Comment